Pull structured & unstructured data from bureaus, open banking APIs, behavioral sources, and alt-data feeds - with auto-normalization pipelines.

Extract high-impact, explainable features using machine learning and domain-driven logic tailored to credit risk.

Deploy CNNs, RNNs, and LSTMs to model behavioral patterns, delinquency trends, and repayment risks - adapting in real time.

Proactively detect and mitigate bias across sensitive dimensions - with regulatory-ready fairness metrics.

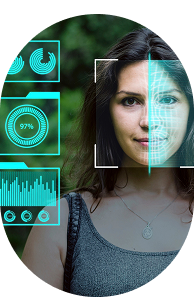

Score users instantly during onboarding or lifecycle events - enabling sub-second credit decisioning.

Track performance with Gini coefficient and AUC-ROC to ensure consistency across borrower segments and products.

Use XGBoost, LightGBM and other ensemble techniques to drive accuracy - even in thin-file or underserved segments.

Connect seamlessly with LOS, LMS, CRM and third-party systems - with secure, versioned APIs.

PhotonMatters’ AI Scoring Engine powers the future of fair, data-driven lending – at scale.